What to Do When Your Home Isn’t Selling: The Three Pathways™ for a Shifting Market

- Rowena Patton

- Nov 13, 2025

- 16 min read

Updated: Nov 16, 2025

Take our quick quiz to see which pathway suits you best

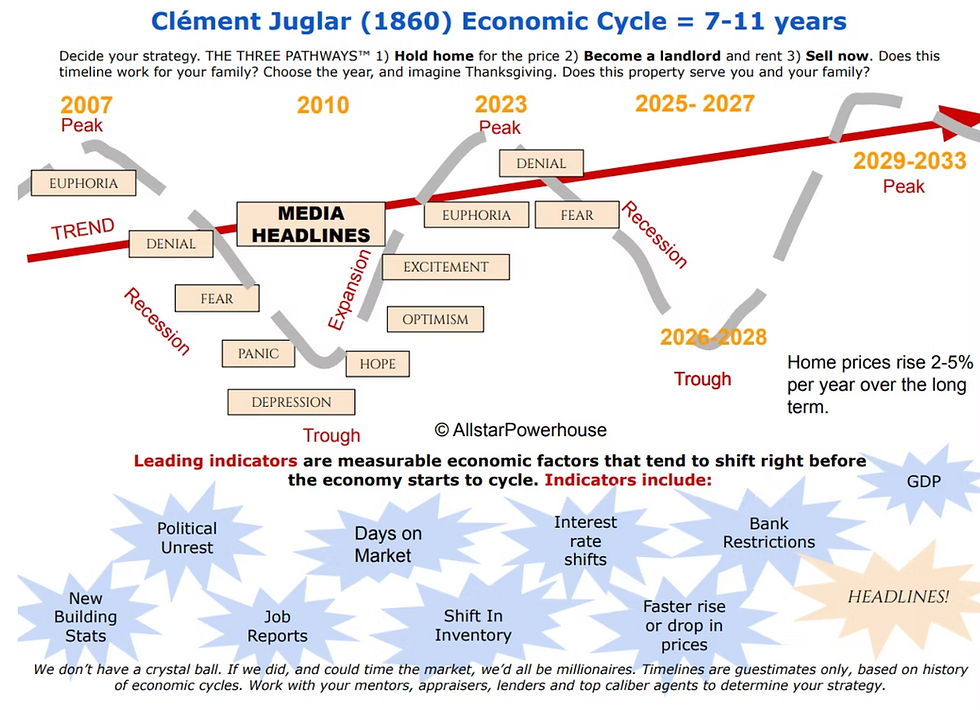

If your home has been listed for more than 30 days without steady showings, the market is quietly giving you advice. Each week of inaction costs opportunity. Whether you decide to hold, rent, or sell, the power lies in acting intentionally rather than waiting for the market to decide for you. The real estate market, like the broader economy, moves in cycles. The Clement Juglar Economic Cycle, first described in 1860, shows that housing and business markets typically rise and fall in patterns lasting seven to eleven years. Each stage: expansion, crest, decline, and recovery — changes how buyers and sellers behave.

Across much of the country, the market has crested and begun to cool. Homes that once sold in a weekend are now taking months. Buyers are cautious, interest rates are higher, and sellers are recalibrating expectations. It's not about 'what happens in the spring', the next political cycle, interest rates etc - while each of these factors (and many more factors) have an impact, the housing cycle is like a huge ship that takes a while to change direction. The only time it moves faster is when buyers and sellers lose confidence, think of the 'fear' headlines like the iceberg! In a crested market, stop procrastinating and choose your pathway now - don't wait for the iceberg! look at the shift diagram and read the cycle, and of course, don't hesitate to reach out to discuss your strategy.

If your home hasn’t sold, you really have three clear options. Each can work, but the right one depends on where you are in the cycle, and on your goals, timeline, and comfort with risk. Spend the time now to consider which best suits you, especially if you are in the parts of the country that are declining, as every week of procrastination can cost you.

Understanding the Clement Juglar (1860) Economic Cycle - especially when Your Home Isn’t Selling

The Three Pathways™ - Your Strategy in the Cycle - especially When Your Home Isn’t Selling

As shown in the Juglar Cycle chart above, the market passes through predictable emotions of optimism, denial, fear, and recovery roughly every 7 to 11 years. Your best move depends on where you enter that curve.

That’s where The Three Pathways™ come in:

Hold your home long-term and ride out the cycle.

Rent it and collect income until the next incline.

Sell strategically now to protect your equity.

Each choice fits a different phase — declining, crested, or inclining — and your decision determines whether you react to the headlines or anticipate what comes next.

The Three Pathways™ in Different Market Phases

Pathway A: Hold with a 10-Year Mindset

V Declining Market

When the market is sliding down the Juglar curve, patience is often the safest play. Selling during a contraction usually means accepting less than the home’s long-term value. If you can hold for 7 to 10 years, you’ll likely span a full cycle and emerge stronger in the next upswing. Use this period to pay down principal, refresh the property, and protect equity. The goal is not a quick gain, it is preservation until buyer confidence returns and supply tightens again. Especially when your home Isn’t selling

> Crested Market

At the crest, prices have flattened and demand has softened. Holding still makes sense if the home fits your lifestyle or offers features that are hard to replace. Values may stay flat for a while before the next incline, but you’ll avoid selling into uncertainty. This is the perfect phase for light improvements such as fresh paint, landscaping, or energy upgrades that lift future value without over-investing.

^ Inclining Market In a rising market, long-term holders are rewarded as appreciation compounds. Riding the full Juglar cycle allows multiple years of growth, rental potential, and tax advantages. The only risk is missing a short-term profit window mid-cycle, but overall this path favors those building generational wealth or using real estate as a hedge against inflation.

Pathway B: Rent with a 7-to-10-Year Exit Plan, Especially When Your Home Isn't Selling

V Declining Market

Renting during a downturn can cushion expenses while you wait for recovery, although rents rarely cover full carrying costs on high-value homes. Tenants can offset part of the mortgage, HOA, and taxes, reducing your monthly outflow until prices normalize. Keep in mind that by the time you sell, the home will have aged and may lose its “new” - or remodeled or refreshed - appeal, but you’ll likely re-enter the market as it swings back upward, having bridged the toughest years.

> Crested Market

As the market flattens, rental demand often strengthens because would-be buyers are sidelined by interest rates. Leasing your property during this phase can stabilize cash flow and buy you time to watch which way the cycle breaks. A professional property manager can protect your asset while you wait for clearer signals. When the next incline begins, you’ll have options: sell into rising prices or continue collecting rent as a long-term investment.

^

Inclining Market

In an incline, rents are healthy and values are climbing, unless the area has seen overbuilding for rental units, where the supply outstrips the demand. Renting for a short period while monitoring appreciation can be a strategic move, particularly if you expect the peak to continue another few years. However, holding too long risks missing the optimal sale window at the top of the cycle. The best approach here is to define your timeline early and treat the property like a business asset by monitoring maintenance costs, tenant quality, and market data so emotion doesn’t drive the decision.

Pathway C: Get Aggressive and Sell Now

V Declining Market

In a declining market, speed matters. Pricing aggressively, marketing well and using an experienced agent - early - allows you to stay ahead of the curve rather than chasing it downward through multiple reductions. Selling now may mean accepting less than your perceived value, but it can preserve equity that might otherwise erode as the decline deepens. Think of it as stepping off the slide before it gets steeper. Those who adapt fastest to market feedback tend to exit with the least damage and the most control, and feel the least stress throughout the process. This is not a time to procrastinate.

> Crested Market

After a crest, competition increases and buyers regain leverage. An assertive price adjustment can separate your home from the pack and capture attention while inventory is still moderate. The first 30 days on market remain crucial because momentum drives offers, and your listing should generate a showing almost every day if it’s priced right. This strategy suits sellers who are ready to move on and don’t want to carry the property through a six-to-twelve-month listing cycle. When in the crest cycle, don't try to time the market unless you have a high risk tolerance.

^ Inclining Market In a climbing market, aggressive pricing isn’t about undercutting; it’s about positioning slightly ahead of rising comparables to attract early bidders. Sellers who list smartly near the start of an incline often spark bidding wars and sell at or above asking before the peak. If your next move depends on freeing equity or locking in gains, selling into strength can be just as strategic as buying low. What's more, take a look at what is happening around the country, if other areas are in the declining phase, it's either likely heading your way, or you are affected by it as buyers move around the country these days, and may be being hit hard in their area.

Reading the Market’s Pulse

The Clement Juglar seven-to-eleven-year cycle reminds us that no market condition is permanent. Peaks and troughs aren’t good or bad; they’re simply timing mechanisms. Smart sellers adjust before the headlines confirm what they already sense.

If your home has been listed for more than 30 days without steady showings, the market is quietly giving you advice. Each week of inaction costs opportunity. Whether you decide to hold, rent, or sell, the power lies in acting intentionally rather than waiting for the market to decide for you.

Quick Quiz: Which Pathway Fits You Best?

Here’s a quick self-assessment to help you decide which of the Three Pathways™ may fit you best:

1. Your Timeline

Are you planning to move within the next year, or can you hold comfortably for five to ten years?

2. Your Cash Flow

Can you afford the monthly payments, maintenance, and taxes if it takes longer to sell, or do you need liquidity now?

3. Your Stress Tolerance

Would you sleep better knowing your property is sold, or are you comfortable riding through market shifts?

4. Your Long-Term Goals

Is this your forever home, a future retirement plan, or an investment you’ll eventually sell?

5. Your Market Outlook

Based on local data and professional guidance, do you believe your area is declining, leveling, or beginning its next incline?

Your answers reveal more than numbers; they define your strategy mindset. Once you identify where you are in the cycle, the right choice often becomes clear.

Answers:

1. Do you need to move in the next 12 months?

Yes → You may be a Pathway C seller.

Not necessarily → Continue below.

2. Are you comfortable managing a rental or hiring a property manager?

Yes → Pathway B may help you build wealth while waiting for the next incline.

No → Continue below.

3. Do you believe your property’s long-term value outweighs short-term market dips?

Yes → Pathway A could be your best fit.

No → Revisit Pathway C for a proactive exit.

Every property is part financial asset, part personal story. In a declining market, the goal isn’t to win; it’s to protect your position and prepare for the next rise in the cycle.

If history holds true, the next crest is already forming on the horizon. Want to see where your local market sits on the Juglar curve? Request a personalized market snapshot today and make your next move with confidence.

Pricing Strategies by Market Phase

When you have decided to sell, there are several pricing tactics you can use depending on whether you are in a declining, crested, or inclining market. Pricing is both an art and a science. It is how you position yourself in the story of the market rather than simply reacting to it.

Many sellers naturally put their identity into the list price. It feels personal, because it represents years of work and care. But the list price is not the value of your home — it is simply a strategy. Once you understand that the list price is an invitation to the market, not a declaration of worth, you gain control.

Let’s look at how pricing strategy — aspirational, perceived market value, and event-based — shifts depending on the market you are in, and how CashCPO can serve you in each phase.

V Declining Market

In a declining market, speed and visibility matter most. Once prices begin to slide, the best-kept and best-priced homes sell first. As those go under contract, supply grows, demand shrinks, and prices fall further.

Aspirational pricing — listing above where the market currently is — almost never works here. Buyers are cautious and oversupplied with choices. Even small overpricing pushes your home out of search filters completely.

The most effective approach is perceived market value pricing, grounded in what buyers are paying today. When values are falling, pricing directly at or even slightly below recent comparables gets you ahead of the decline instead of chasing it.

To attract attention, you can blend in elements of event-based pricing, listing just below market to generate momentum before conditions worsen. Buyers love a deal, even in a cooling environment. Even better than comparables, use the Certified Pre-Owned approach, inspect and appraise your home, and list slightly below appraisal, and make a big deal about it!

If the data shows a forecast drop or an actual drop for 3 months in a row (or sooner if you are ready to sell), act fast. At the very least, use micro price drops — even $100 a week — to refresh your listing online and trigger new alerts.

The best approach is to land between weekly and monthly one percent adjustments that can also keep you nimble and prevent the slow bleed of chasing the market downward. The downside of monthly, is that if you change only monthly, you have lost a month, instead of a week. In most States, agents can write in the drop to the listing paperwork, avoiding all the paperwork that you have to keep filling out as a seller. They can also halt it along the way if you want to take a break.

Buyers have 3-6 auto searches set up on average, and your home shoots out to them when it first lists, and then doesn't go on auto pilot - until you lower the price. That's why you see a showing after each price drop - even when it's a micro-drop.

CashCPO in a Declining Market Full-market-value cash offers often come with a short-term fee structure in this environment, since the program takes on more risk during a downturn. If you use CashCPO in a declining market, it’s vital to review the monthly carrying cost or fee with your agent and calculate the breakeven timeline. The upside? You get certainty and speed — your home is improved and remarketed professionally, which is crucial when buyers are comparing freshly renovated listings. In a market where supply is growing and prices are falling, having a show-ready home backed by instant liquidity can be the difference between selling and sitting. Event-based pricing will be critical in this scenario, with price drops built in to move fast.

> Crested Market

At the crest, prices have plateaued, demand has softened, and the market is waiting to see which way it will turn. This is often where sellers lose valuable time hoping for yesterday’s numbers.

Aspirational pricing is risky here because buyers have become analytical. They know the data and will pass on anything that feels inflated.

Perceived market value pricing tends to work best. Study the last 60 to 90 days of sales and price within that narrow window. It positions your home where buyers are actually engaging, giving you strong showing traffic and fair offers.

If your area allows a coming soon phase, this is the moment to use event-based pricing. List on a Monday, hold off showings until Saturday and Sunday, and create a wave of interest that drives multiple offers. Even in a plateauing market, a single weekend of excitement can make the difference.

If it doesn't make the difference you hoped (the market always knows best when you have a great agent, great photos and the other 'givens) the data shows a drop of a third of a percent per month or more, or shows 2+ months in a row of decline - act fast. At the very least, use micro price drops — even $100 a week — to refresh your listing online and trigger new alerts. Monthly one percent adjustments - if you catch the first decline fast - can also keep you nimble and prevent the slow bleed of chasing the market downward. Buyers have 3-6 auto searches set up on average, and your home shoots out to them when it first lists, and then doesn't go on auto pilot - until you lower the price. That's why you see a showing after each price drop - even when it's a micro-drop.

CashCPO in a Crested Market

This is where CashCPO shines. Because the market is neither fully up nor down, speed becomes your greatest advantage. The short-term fee window for CashCPO is typically smaller in a crested market, meaning you can unlock up to 70 percent of your equity in about 14 days, move forward confidently, and still participate in the upside when the improved home resells. CashCPO bridges that awkward middle ground between “wait it out” and “drop the price.” You move on with funds in hand, while the home is updated, re-staged, and remarketed to compete in a flattening environment.

^ Inclining Market

In an inclining market, buyers are energized and inventory is tight. This is when you can use pricing as a lever for momentum.

Aspirational pricing can work in limited cases — if your property is truly unique, has architectural distinction, or sits in a prized location. But even then, overpricing risks missing the strongest wave of buyers who rush in early.

Event-based pricing is often the most powerful strategy in this phase. Listing just below the perceived market value creates a competitive, auction-like atmosphere that drives multiple offers and can push the final price above expectations. This method aligns perfectly with the psychology of buyers in an inclining market: they fear missing out. It also saves you lots of showings, and you and your agent can set your home as 'coming soon' on Monday, open it on Saturday and or Sunday for 2 hours, when it looks at its shiny best, and then discuss all the offers in place once you have given the deadline of all offers requested by Sunday at 5pm. Less stress throughout!

Perceived market value pricing also works well for those who prefer predictability. Listing at true market range often yields fast offers without sacrificing price, especially when paired with a strong coming-soon launch.

CashCPO in an Inclining Market

In a rising market, CashCPO’s dual-check model is especially powerful. Two-thirds of sellers who use it end up netting more than with a traditional sale, because the program improves and repositions the home at full market exposure once the initial purchase is complete. You unlock up to 70 percent of your equity upfront within 14 days, skip the showings and disruptions, and receive a second check when the home resells. Even in an incline, presentation is everything — and with CashCPO, your home re-enters the market in top form, competing as if it were brand new. The best presented homes almost always bring the most money to your pocket.

Final Note on Pricing Strategy

Pricing tells a story. You are not only naming a number; you are sending a signal. The most successful sellers treat the list price as a living strategy — something to be refined in partnership with their agent as the market moves.

Ask your agent to plot your area’s data on the Clement Juglar seven-to-eleven-year cycle. The pattern is remarkably consistent. The short term may be unpredictable, but the long arc of supply and demand always tells the truth. You wouldn't think so if you watch the news, however many of the people giving opinions are paid by selling things to real estate agents, or have another agenda regarding real estate.

Need to Sell but Want Options?

Before making major reductions, consider our CashCPO offer. With CashCPO, you can access up to 70 percent of your equity within 14 days, then receive a second check when your home resells — so you can move forward without waiting for a traditional closing.

Enter your property at www.CashCPO.com to see how the numbers work for your situation. It’s a simple, transparent way to sell strategically in any market phase, and of course, there is no obligation. Just choices.

November 2025 - source Reventure - Home Price Forecast

Note that many areas within a State wildly fluctuate - contact us here with your zip or address and we will send you a zip code deep dive.

Want to see some more zip code deep dives with maps of areas? Head to www.HousingFigures.com

Why Sellers and Builders Offer Mortgage Buy downs in a Shifting Market

See lenders that offer them here

When mortgage rates rise or buyer demand softens, sellers and builders look for effective ways to make their home stand out. One of the strongest tools in a competitive market is the temporary mortgage buydown, especially the well known

2/1 buydown.

A buydown means someone pays upfront to temporarily reduce the buyer’s interest rate. It can be the seller, the builder or the lender. The buyer receives lower monthly payments for the first one to three years, which makes the home more affordable and easier to qualify for.

For sellers, this can be far more powerful than a simple price reduction and is often less expensive.

Why sellers use buy downs

Sellers in a slowing or price-adjusting market usually face the same challenge. Buyers are stretched, monthly payments are higher and fewer people can qualify.

A buy down solves this by creating affordability without permanently lowering the price.

A ten thousand dollar seller credit used for a buydown can reduce the buyer’s monthly payment by hundreds of dollars.• A ten thousand dollar price reduction usually lowers the payment by only fifty to sixty dollars.

Many sellers now choose to advertise that they will provide a temporary 2/1 buy down credit with a full-price offer. This attracts more qualified buyers because they see an immediate, meaningful reduction in their monthly payment while keeping the seller’s final sale price intact.

Why builders use buy downs

Builders use buy downs because they must protect the future value of the entire community. If a builder cuts prices on just a few homes, it hurts appraisals for every home in the neighborhood.

Instead, builders offer incentives such as:

temporary 2/1 or 3/2/1 buydowns• permanent rate reductions• closing cost credits applied to rate improvements• builder funded rate incentives through preferred lenders

This helps them sell without damaging the price structure of their development.

What is a 2/1 buydown

A 2/1 buy down reduces the buyer’s interest rate for the first two years.

Year one is two percent lower.

Year two is one percent lower.

Year three and beyond return to the original note rate.

Buyers get payment relief. Sellers get more attention on their listing. Builders keep values stable.

What a 2/1 buydown costs a seller in 2025 using a 6 percent rate

When mortgage rates trend around six percent, seller-paid buy downs are even more attractive because the cost is lower and the buyer still receives a meaningful payment reduction.

Here are typical numbers.

For a four hundred thousand dollar loan at six percent

Year one subsidy is about seven thousand two hundred dollars.

Year two subsidy is about four thousand dollars.

Total cost is about eleven thousand two hundred dollars.

For a three hundred thousand dollar loan at six percent

Year one subsidy is about five thousand four hundred dollars.

Year two subsidy is about three thousand dollars.

Total cost is about eight thousand four hundred dollars.

For a two hundred fifty thousand dollar loan at six percent

Year one subsidy is about four thousand five hundred dollars.

Year two subsidy is about two thousand five hundred dollars.

Total cost is about seven thousand dollars.

These are estimates, but they reflect what sellers and builders are offering across the country.

How a seller offers a 2/1 buy down

Offering a buy down is straightforward.

The seller agrees to provide a credit at closing

The buyer’s lender uses that credit to fund the 2/1 buydown.

An escrow account is created to subsidize the buyer’s payment for the first two years.

The buyer automatically receives the reduced payments.

Your real estate agent writes this into the offer in a way that meets lender guidelines.

Many agents advertise it as “Seller will provide an interest rate buy down credit with a full-price offer,” which signals value without lowering the asking price.

Why buy downs matter in a cooling market

As prices soften or level off, sellers want to avoid repeated price drops. A temporary buy down offers several advantages.

It attracts more buyers.

It helps borderline buyers qualify.

It protects the seller’s final sale price.

It reduces days on market.

It positions the home ahead of competing listings.

It provides immediate value buyers can feel.

It is one of the most noticeable incentives a seller can offer in a buyer's market.

When a 2/1 buy down makes the most sense

Temporary buy downs are especially effective when:

mortgage rates are higher than normal

buyers need early payment relief

sellers want to stand out without cutting price

a home has been on the market longer than expected

builders must protect neighborhood values

buyers expect to refinance within one to three years• a seller wants to attract more qualified buyers quickly

The bottom line

Temporary 2/1 buy downs have become one of the most effective seller incentives.

They help buyers say yes sooner, give sellers a competitive advantage and often have a larger impact than price reductions.

If you are considering selling, talk with your agent about whether a 2/1 buy down or similar incentive could help your home sell faster and more smoothly while protecting your equity.

Find your agent

Comments